Psychology

The Psychology of Crypto-Asset Users

There are three groups of crypto investors: cypherpunks, hodlers, and rookies.

Posted June 25, 2021 Reviewed by Ekua Hagan

Key points

- One of the main challenges to the widespread adoption of cryptocurrencies is how best to manage risks.

- To help mitigate the security challenge, a team of researchers examined the psychology of 395 crypto-asset users.

- Data from 2 scales revealed 3 clusters of crypto-asset users with highly distinct psychological characteristics and personal histories.

The adoption of cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL), has risen dramatically during the last few years, as retail investors from all socio-economic backgrounds have started trading and investing in digital assets.

One of the main challenges to the widespread adoption of cryptocurrencies is how best to manage the risks, not only of investing in crypto, but also of storing, moving, and using digital currencies—a problem perpetuated by the rise in inexperienced retail investors diving into this asset class.

In a new study, Svetlana Abramova and colleagues set out to make headway on this problem. Based on an analysis of data from 395 crypto-asset users, the team designed a new typology of users that can help inform future crypto-asset solutions and speed up the widespread adoption of this new asset class.

The Problem of Crypto Security

Cryptocurrencies are digital currencies secured by cryptography. To understand cryptography, imagine that you were to send an impenetrable shrine full of diamonds to your friend in another country. To ensure safe arrival, you secure it with a private lock no one can tamper with. When your friend receives the shrine, she cannot access the diamonds, as she doesn't have your private key. However, she can add her own private lock to the shrine and ship it back to you. Once you confirm that the added lock belongs to your friend, you can remove your own lock and ship the shrine back to your friend, who can now access the diamonds. This is how the cryptography that secures crypto-assets works.

Most cryptocurrencies (e.g., Bitcoin, Ethereum, and Solana) run on decentralized networks that rely on blockchain technology. A blockchain is a distributed ledger that permanently records all crypto transactions. A network of computers validate crypto transactions, which are then added in blocks to the ledger. Due to the decentralized nature of blockchains, no central authority can interfere with or manipulate the asset.

While crypto-asset users can leave their coins and tokens on central cryptocurrency exchanges, the risks of hacks on such exchanges give users a strong incentive to keep their assets in a wallet. Cloud-based wallets are popular choices but are at least as vulnerable to hacks as exchanges.

A safer option is cold storage, which is basically a flash drive that can only be accessed with a private key. Regardless of the choice of wallet, if a crypto-asset user loses their private key, their stored cryptocurrency is lost for good. Indeed, four million Bitcoin, worth tens of billions of dollars, are lost forever due to lost or forgotten keys.

Sending crypto-assets to and from exchanges poses additional risks, as even a minor typo in the address can entail a permanent loss of the crypto-asset. How wallets and exchanges are designed can help prevent such irreversible losses.

The burgeoning interest in central bank digital currencies only exasperates the security issues surrounding cryptocurrencies. Investors in central cryptocurrencies who don't trust banks to manage their keys will be equally prone to mistakes, potentially costing banks a fortune in insurance.

Three Data-Driven Clusters of Crypto-Asset Users

To better understand crypto investors' psychology, Abramova et al (2021) analyzed data collected from 395 crypto-asset users on five psychometric scales:

- Perceived Severity (e.g., "Losing crypto-assets would likely cause me severe stress.")

- Perceived Vulnerability (e.g., "My crypto wallet is at risk of being compromised.")

- Perceived Self-efficacy (e.g., "I am able to protect my private key from being stolen.")

- Response Cost (e.g., "Spending crypto-assets from secure crypto wallets is costly.")

- Perceived Concern (e.g., "I am concerned about security vulnerabilities of exchanges.")

In addition to the scale items, the survey materials included questions about ownership, storage, other risk factors, security practices employed, and demographics.

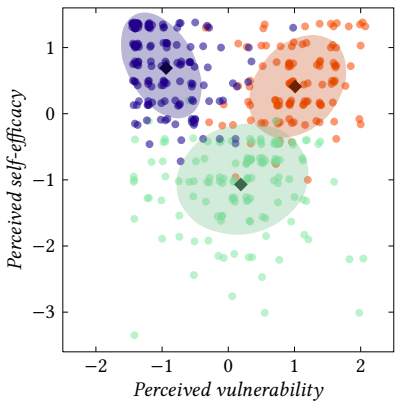

The team found that the participants' responses to Perceived Vulnerability and Perceived Self-Efficacy fell into three clusters (blue, orange, and green).

Blue users perceived their vulnerability to security threats as quite low and had complete confidence in their ability to protect keys and wallets on their own.

Although orange users scored lower than blue users on Perceived Self-Efficacy, they had fairly high confidence in their ability to exercise self-protection, yet they worried much more about security and tended to exercise greater caution around their crypto-assets.

Green users stood out in terms of their significantly lower Perceived Self-Efficacy. They had much less confidence in their ability to protect their wallet and keys.

Cypherpunks, Hodlers, and Rookies

Abramova et al (2021) subsequently analyzed the self-reported data and chose to label the three clusters Cypherpunks (blue), Hodlers (orange), and Rookies (green). The self-reported data revealed that Cypherpunks were early adopters of crypto (prior to 2017).

Cypherpunks entered the crypto space, not as a way of generating wealth as many had no income or assets to speak of at the time, but because they had become obsessed with crypto out of technological interest or ideological conviction. Thirteen percent got involved prior to 2014 when Bitcoin cost less than $13.

Although Cypherpunks were early adopters who bought crypto when the Bitcoin highest price point was $770 (prior to 2017), only 14.5 percent reported holding more than $100,000 in cryptocurrency and 17 percent preferred not to disclose the size of their holdings as opposed to 2 percent in the other clusters. Most Cypherpunks exclusively invested in crypto-assets.

Rookies entered the crypto space recently out of FOMO (fear of missing out). They were primarily motivated by the average 3X annual gain of Bitcoin or 10X or higher annual gain of altcoins with smaller market caps. Whereas only 12 percent of Cypherpunks were male, 33 percent of the Rookies were women. Rookies also included a significantly greater number of older crypto-asset users (25 percent).

Most Hodlers reported being middle-aged and entering the crypto space during the record surge in 2017, motivated by the large gains. Unlike Cypherpunks, Hodlers tend to invest in the traditional stock market as well. Twenty-five percent of Hodlers reported owning more than $100,000 in crypto-assets.

Taken together, the findings reveal key differences between three groups of crypto-asset users that can help inform the design of future crypto-asset solutions.

References

Abramova, S., Voskobojnikov, A., Beznosov, K., Böhme, R. (2021). Bits Under the Mattress: Understanding Different Risk Perceptions and Security Behaviors of Crypto-Asset Users. Conference Paper. CHI Conference on Human Factors in Computing Systems. May 2021. https://dl.acm.org/doi/abs/10.1145/3411764.3445679